Clerical Mistake in 80G Filing: ITAT Mumbai Grants Relief to Educational Trust

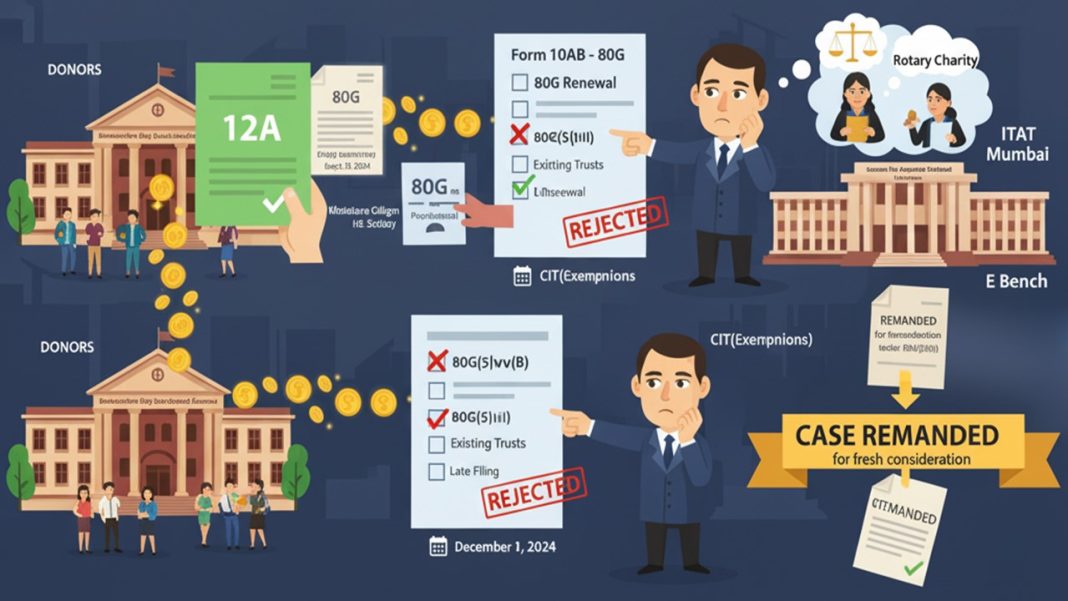

A trust tried to avail renewal of a tax benefit (under Section 80G). While applying for the same, I made a minor mistake while filing the form and selected an incorrect option. Despite trying to correct the mistake, the tax officer issued an order rejecting its application.

The present appeal (I.T.A. No. 4473/Mum/2025) has been filed by Khairul Islam Higher Education Society (appellant) in the Income Tax Appellate Tribunal “E” Bench, Mumbai, before Smt. Beena Pillai (Judicial Member), against CIT(Exemption) (respondent). The appeal is related to the present assessment year, 2024-25. The judicial members announced their decision on September 30, 2025.

The appeal has been filed to challenge an order dated 24/05/2025 passed by CIT(Exemptions), Mumbai, for the assessment year 2024-25.

Background of the Case:

Khairul Islam Higher Education Society (appellant) is a trust registered under the Bombay Public Trust Act, 1950 and is running a college in Mumbai called Maharashtra College of Arts, Science and Commerce, established in 1971. The trust gets funds from the government to pay revenue to its teaching faculty, and it is completely involved in educational activities, which qualifies it as a charitable organisation under the Income Tax Act.

The trust already possesses a valid registration under Section 12A of the Income Tax Act, which exempts its income from tax. It also had provisional registration under Section 80G, which allows donors to claim a deduction when they donate to this trust. But this provisional registration was only valid till March 31, 2024. Therefore, the trust was required to apply for a final/renewed 80G registration to continue getting the advantages.

What was the mistake made in filing?

The trust applied for the final/renewed 80G registration and filled the renewal application (on May 18, 2024-within the statutory deadline). However, at the time of furnishing online Form 10AB, it mistakenly selected the wrong section of law. Instead of selecting the correct clause, 80G(5)(iii) (which applies to existing trusts seeking renewal), they wrongly selected 80G(5)(iv)(B) (which applies to new applicants). Because of this minor mistake, the Commissioner of Income Tax (Exemptions) rejected their application.

To correct their mistake, the trust again filed a second renewal application on December 2, 2024, and this time selected the correct option. This second application was filed to correct the error in the first application; however, the CIT(Exemptions) again rejected their application. For this rejection, the department gave the reason that the application was filed late from the allowed legal deadline and ignored the fact that the first application was filed within the time.

What the Tribunal Decided:

When the matter was brought before the Income Tax Appellate Tribunal “E” Bench, Mumbai. The tribunal analysed the facts and key documents of the case and concluded that the trust is an old and genuine educational trust. It has valid registration under Section 12A and previously had provisional registration under 80G. The trust had filed its first application within the legal deadline and selected the wrong option in the form by mistake. However, it again filed a second application correcting a mistake in the first application, not a fresh application.

To announce its decision, the tribunal cited a previous judgement associated with the same matter of other assessee(s) (like in the Rotary Charity Trust case). The tribunal held that just because the wrong section was selected by mistake, the application should not have been rejected. They believed this was a genuine clerical error and not a reason to deny approval.

Therefore, in the final ruling, the tribunal did not directly grant the 80G approval to the trust but remanded the case to the CIT(Exemptions) for fresh consideration and directed it to reconsider the application under the correct section, Clause (iii) of the first proviso to Section 80G(5). Additionally, instructed the officers to issue an order as soon as possible, before the expiry of the provisional approval, so that the trust can continue receiving donations with 80G benefit without any break.

Thus, the appeal of the trust was allowed partially, meaning the trust got relief, but the final decision is now in the hands of the CIT(Exemptions), who must review the case afresh.

Citation: Khairul Islam Higher Education Society Vs CIT (Exemption) (ITAT Mumbai); I.T.A. No. 4473/Mum/2025; 30/09/2025; 2024-25