CBDT Notification: PAN-Aadhaar Linking Now Compulsory for All Taxpayers

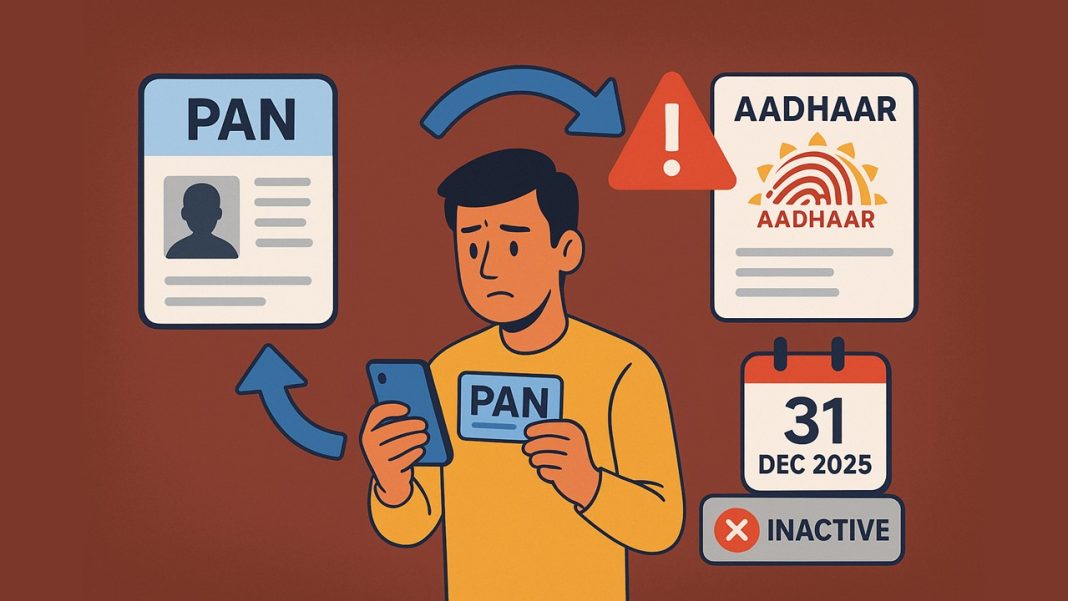

The Central Board of Direct Taxes (CBDT) has made it compulsory for everyone to link their PAN with their Aadhaar. If you don’t do this before the deadline, your PAN will become inactive, and you won’t be able to use it for any financial or official work.

The government has scheduled December 31, 2025 as the last date to link PAN with Aadhaar. PAN cards not linked by the deadline will be deactivated from January 1, 2026.

The new process now requires people applying for a new PAN card to verify their identity using their Aadhaar. This helps make sure that a person’s details are the same in both their PAN and Aadhaar records.

What happens if my PAN is deactivated?

If you lose your PAN card, it may attract trouble with the authorities. other than this, you may face many problems:

- You can’t open a bank or demat account or make cash or fixed deposits over Rs. 50,000.

- Since a demat account needs a PAN, you can’t invest in the stock market or start SIPs.

- You can’t apply for government financial schemes.

- Banks won’t give you loans without an active PAN.

- You can’t buy or sell property or vehicles.

- You can’t do foreign currency transactions over Rs. 50,000.

- PAN is also required to run a business.

How to link PAN with Aadhaar?

You can easily link your PAN with Aadhaar by following the below-mentioned step:

Step 1: Go to the Income Tax e-filing portal.

Step 2: Click on the ‘Link Aadhaar’ tab on the left panel.

Step 3: Enter your PAN and Aadhaar number and select the ‘validate‘ button.

Step 4: This will finish the procedure to link your PAN to your Aadhaar number.