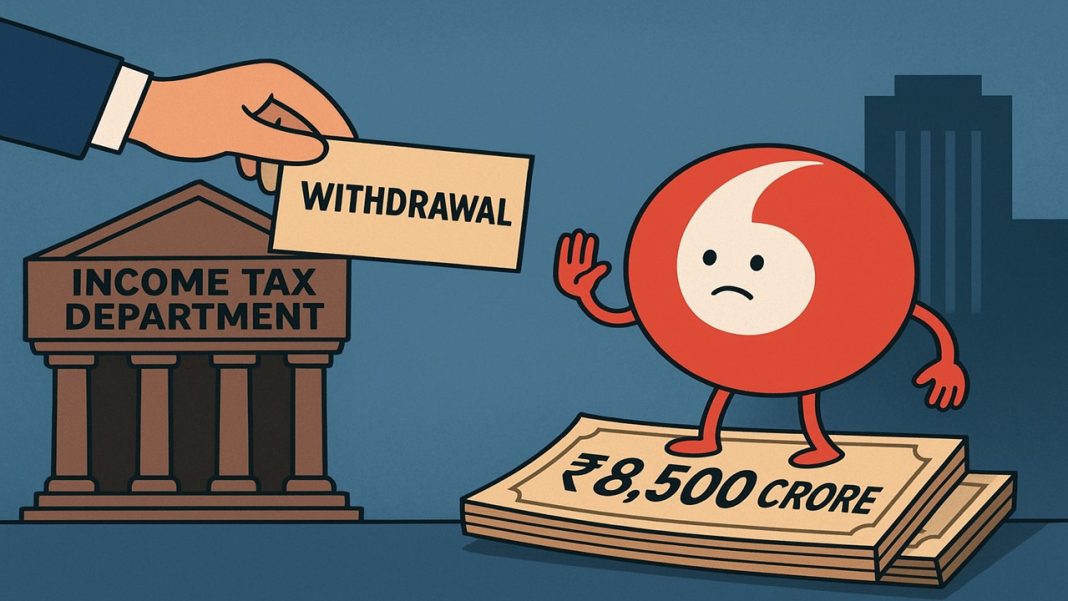

Income Tax Department Withdraws Rs. 8,500 Crore Tax Case Against Vodafone India

The Income Tax Department has decided to withdraw its long-pending Rs. 8,500 crore tax case against Vodafone India Services Pvt. Ltd. The case, which had been stuck since 2016 with no progress after 2017, was officially withdrawn after the department asked the Supreme Court for permission to do so. This move comes after the Supreme Court gave relief to Vodafone Idea Ltd regarding its adjusted gross revenue (AGR) dues.

The Court recently clarified that the government could review and reconsider Vodafone Idea’s total AGR dues up to the financial year 2017 including interest and penalties, not just the extra amount that was previously demanded. This decision brings major relief to the financially struggling telecom company.

The tax case, goes back to the financial year 2008, started after Vodafone India sold its Ahmedabad-based call centre business and earlier called 3 Global Services Pvt. Ltd., to Hutchison Whampoa Properties (India) Ltd. as part of an internal restructuring. Following this deal, the Income Tax Department, in October 2012, claimed that Vodafone had carried out an undisclosed international transaction. Thereafter, issued an order under Sections 143(3) and 144C(13) of the Income Tax Act, 1961, accusing the company of not properly reporting the deal and raising a transfer pricing dispute.

The department claimed that the offer involved the transfer of call options and intangible rights of commercial value to a related entity, qualifying it as an international payment under Indian transfer pricing rules.

Considering this, the department sought to add Rs 8,500 crore to Vodafone’s taxable income, alleging that the sale had not been conducted at an arm’s length price – a principle that ensures that payments between related parties reflect fair market value as if they were conducted between independent entities.

The Income Tax Appellate Tribunal (ITAT) agreed with the tax department in 2014, saying that Vodafone’s deal was structured to avoid India’s transfer pricing rules. The tribunal said that tax authorities were right to review the deal and that Vodafone India didn’t properly explain how it decided the value of the assets and options it transferred.

Vodafone then went to the Bombay High Court, arguing that the deal was only between two Indian companies, so international transfer pricing laws shouldn’t apply.

In October 2015, the Bombay High court favored Vodafone and quashed the ITAT’s order and the tax demand. The court observed that the sale of the call centre business was a domestic payment between Indian entities with no cross-border element. Therefore, it held the authorities had no power to consider it as an international payment under the transfer pricing framework.

The court said that the Income Tax Department went too far by applying transfer pricing rules when there was no foreign (cross-border) element involved. So, the Rs. 8,500 crore tax demand was cancelled.

In 2016, the department appealed this decision in the Supreme Court, but the case stayed inactive for many years. Finally, on Monday, the department withdrew the case.