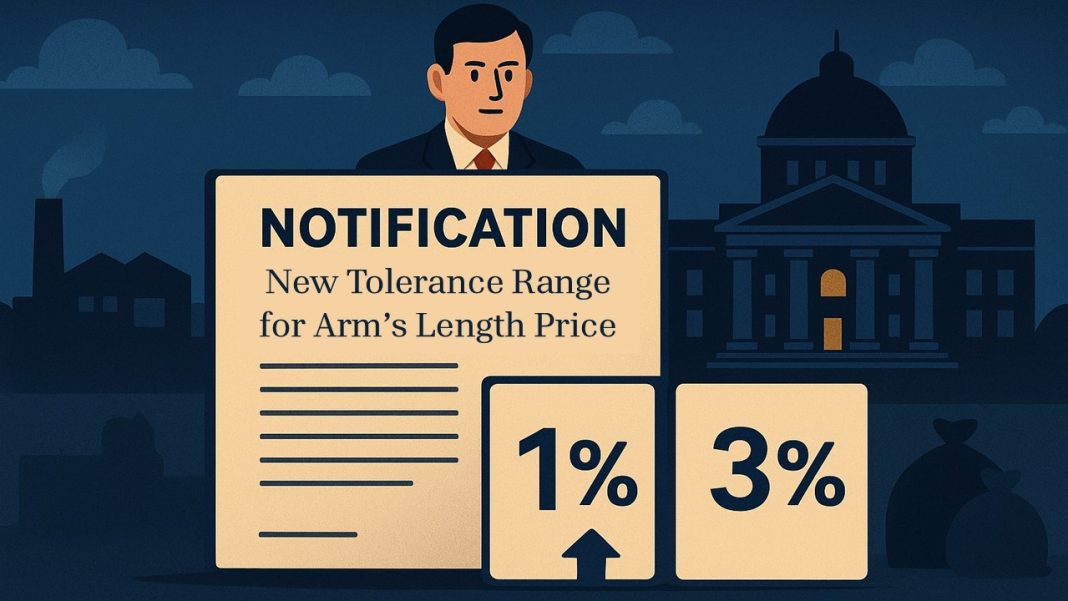

Govt. Notifies New Tolerance Range for Arm’s Length Price: 1% for Wholesale Trading, 3% for Others

The Ministry of Finance (Department of Revenue) has recently issued an official notification [No.157/2025/F. No. 500/1/2014-APA-II], dated November 06, 2025, regarding transfer pricing (that is, pricing between related international or domestic transactions).

Through the present notification, the Central Government of India has served conditions under which an actual international transaction or specified domestic transaction will be accepted as the arm’s length price (ALP)

The notification says that for the financial year 2025-26 (assessment year 2026-27), if the difference between the arm’s length price (ALP) determined under section 92C of the said Act and the price at which the international transaction or specified domestic transaction occurs does not exceed 1% of wholesale trading, or 3% for all other types of transactions, then the actual transaction price will be accepted as the arm’s length price.

The Ministry of Finance has issued this notification in exercise of its powers granted under subsection (2) of section 92C of the Income-tax Act, 1961 (43 of 1961) (hereafter referred to as the said Act), read with the proviso to sub-rule (7) of rule 10CA of the Income-tax Rules, 1962.

For this notification, “wholesale trading” means an international or domestic transaction involving the buying and selling of goods that fulfils both of the following conditions:

- The purchasing cost of finished goods is 80% or more of the total cost belonging to such trading activities, and

- The average monthly closing inventory of such goods is 10% or less of sales belonging to such trading activities.

Note: It applies to businesses mainly buying and selling goods (not manufacturing), where most of the cost is from buying goods, and they do not keep much stock at the end of each month.

The government has clarified that this notification, even though applied retrospectively for the financial year 2024-25 (Assessment Year 2025-26), will not harm anyone’s interests.

Refer to the official notification for complete information