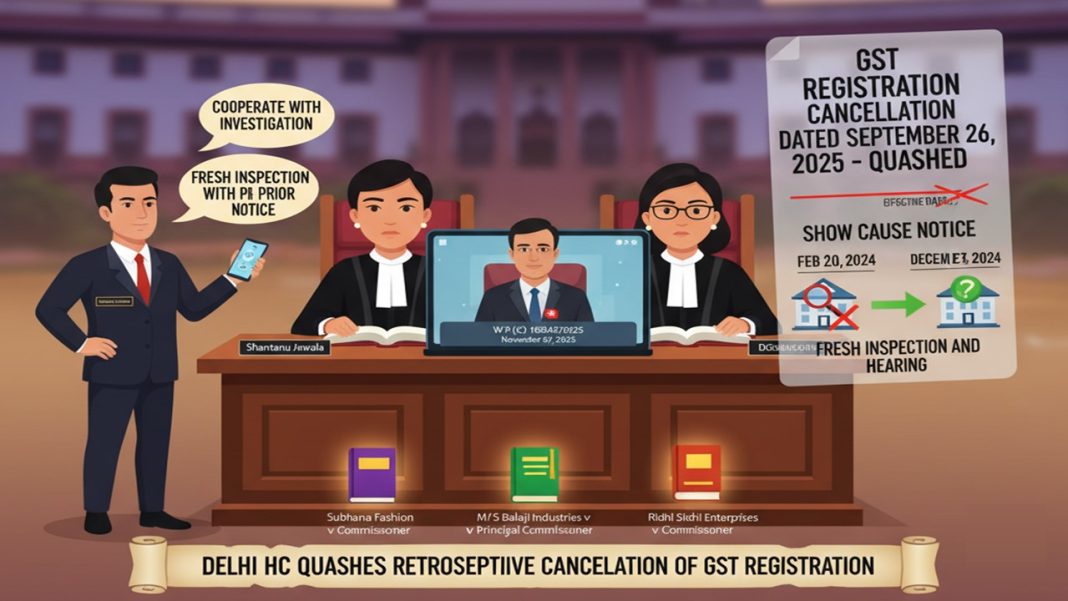

Delhi HC Quashes Retrospective Cancellation of GST Registration, Orders Fresh Inspection and Hearing

The present writ petitioner (W.P.(C) 16845/2025 & CM APPLs. 69232/2025) has been filed by a company named M/S Stalwart India Alloys Limited (Petitioner) against the Union of India and Ors (Respondent) in the Delhi High Court. The benches comprised honourable justices Prathiba M. Singh and Madhu Jain. The case was decided on November 07, 2025, in hybrid mode.

The assessee challenged an order dated September 26, 2025, passed by the Superintendent, Range-36, CGST Commissionerate, Delhi, North Block, New Delhi. Through the impugned order, the department cancelled the GST registration, with effect from February 20, 2024.

Earlier, the petitioner was issued a show cause notice (SCN), dated December 27, 2024, raising allegations against the petitioner that an inspection was conducted at the petitioner’s principal place of business on December 20, 2024, by the Anti-Evasion Branch, CGST Delhi North, but the petitioner was found untraceable on the aforesaid premises. In conclusion, the department cancelled the GST registration of the petitioner.

The petitioner filed a reply to the show cause notice (SCN) on January 04, 2025. In the reply, the petitioner requested the department to reinspect his registered premises. He noted that at the time when the investigation took place at his registered location, he could not appear because a close one died in the family.

The SCN scheduled the date for the personal hearing on January 02, 2025, which was prior to the date of filing the reply to it. When the petitioner approached the Delhi High Court, there were two aspects to be considered:

- First, the petitioner must fully cooperate with the ongoing investigation being conducted by the Anti-Evasion Branch of CGST (North). Mr Shantanu Jawala, the Director of M/S Stalwart India Alloys Limited (Mobile No. 8193091824), has given an assurance that he will cooperate with the investigation.

- Second, the GST Department will carry out another inspection of the petitioner’s premises, but only after giving prior notice to the petitioner.

It is a well-established legal rule that if a Show Cause Notice (SCN) does not mention cancelling a GST registration with retrospective effect, then the cancellation cannot be made effective from a past date.

To support this point, the court cited various judegments titled:

- Subhana Fashion v. Commissioner, Delhi GST

- M/S Balaji Industries v. Principal Commissioner, CGST Delhi North

- Ridhi Sidhi Enterprises v. Commissioner of CGST, South Delhi

Hence, the court quashed the GST registration cancellation order issued to the petitioner. This time, the GST department has been directed to give the petitioner a fresh chance of hearing after carrying out a new inspection of the premises. The petitioner should also submit a reply to the SCN with full details about the premises. After that, a new order will be passed as per the law. All the rights and legal options of both parties remain open. With this, the petition and any pending applications are closed.

Citation: M/S Stalwart India Alloys Limited Vs Union of India & Ors. (Delhi High Court); W.P.(C) 16845/2025 & Cm Appls.69232/2025; 02/11/2025