Annual GST Compliance: Applicability of GSTR-9 and GSTR-9C

GSTR-9 is an annual return to be filed by all regular GST–registered taxpayers, while GSTR-9C is a reconciliation statement that must be filed by registered taxpayers whose aggregate annual turnover exceeds a specified limit in a financial year.

The deadline for filing GSTR-9 and GSTR-9C for F.Y. 2024-25 is December 31, 2025. Failure to file GSTR-9 and GSTR-9C attracts specific late fees for GSTR-9 and a general penalty for GSTR-9C, along with other potential consequences like interest and scrutiny.

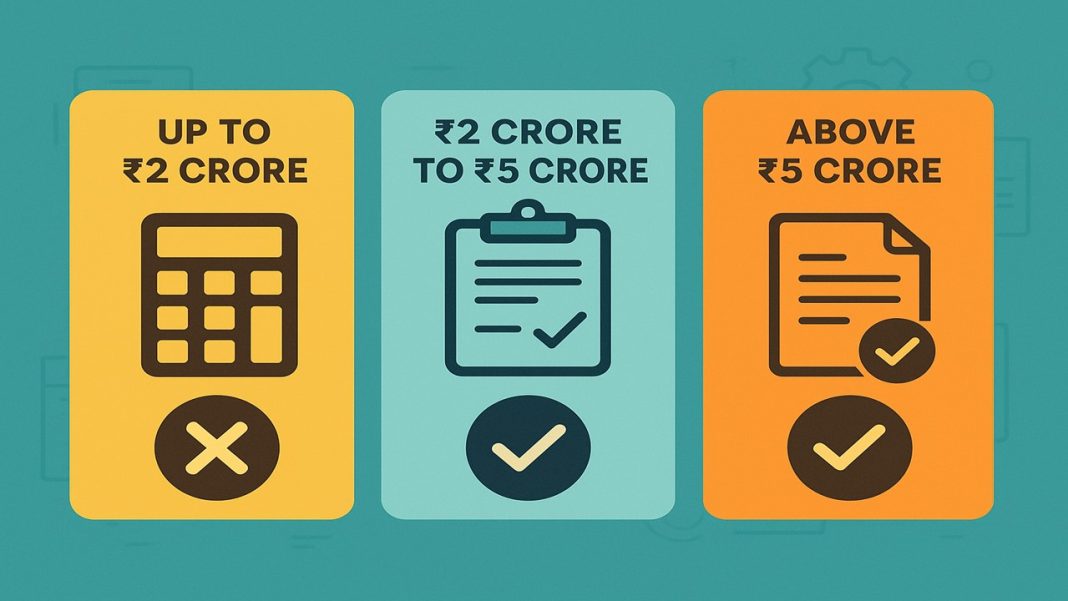

Aggregate Annual Turnover Limit

Following are the aggregate annual turnover limits:

- If your total Annual turnover across India is up to Rs 2 crore, then you don’t need to file GSTR-9 (Annual Return) because it has been exempted by Notification No. 15/2025-CT. Also, GSTR-9C (Reconciliation Statement) is not required for you.

- If your total annual turnover in India is more than Rs 2 crore or upto Rs 5 crore, then filing GSTR-9 is compulsory. However, filing GSTR-9C (the Reconciliation Statement) is not mandatory anymore; it is optional (Exempted).

- If your total annual turnover is more than Rs 5 crore, then filing both GSTR-9 and GSTR-9C is compulsory.

According to Section 2(6) of the CGST Act, 2017, Aggregate Turnover includes:

- All taxable supplies, other than those liable to tax under the reverse charge mechanism (RCM)

- Exports of goods or services or both

- Exempt supplies

- Inter-State supplies made by persons having the same PAN

However, it excludes the value of CGST, SGST, UTGST, IGST, and Cess.