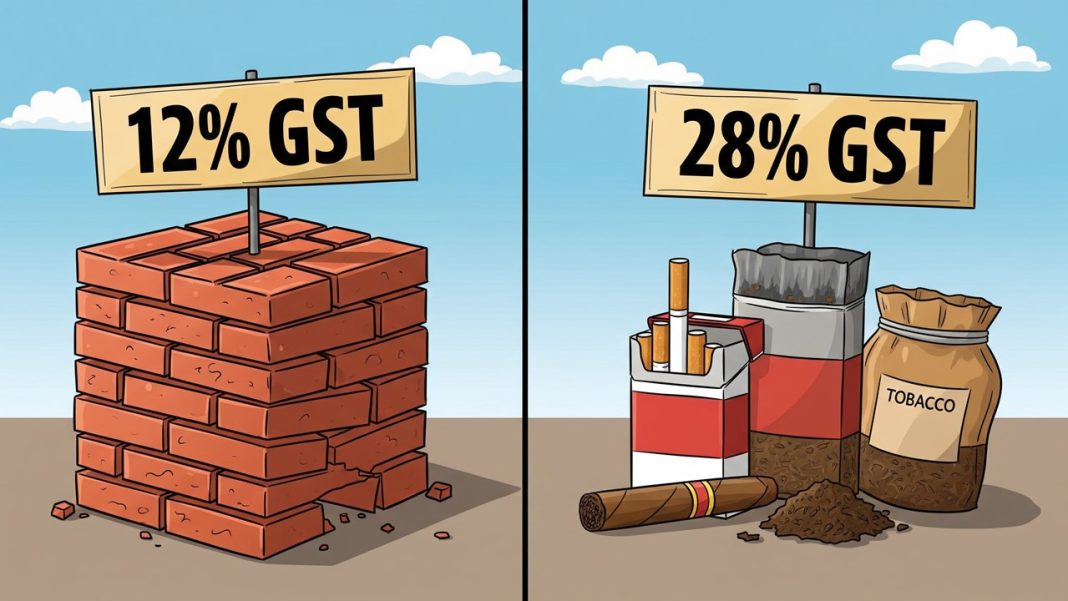

Bricks Likely to Remain in 12% GST Slab and Tobacco in 28% Slab

Government sources have revealed that the central government is expected to keep the bricks in the 12% GST slab and will soon release a notification informing the same. They also say that the tobacco products may be taxed at 28%.

The GST 2.0 introduced by the government reduced GST rates on several daily use items, making goods cheaper for the common man. It is effective from September 22, 2025. The new GST regime has removed the 12% and 28% slabs, making a dual-slab GST system with 5% and 18% GST rates. Many goods are being moved to these standard slabs with no cess. However, exceptions can be made for categories such as bricks and tobacco.

The draft notification is approved by the internal members and is now waiting for the approval of Finance Minister Nirmala Sitharaman. It is expected to be issued this week. The notification will clearly mention that bricks will be the only category that will attract a 12% GST rate

The notification will also outline that tobacco products will remain in the 28% slab along with compensation cess until the borrowings taken during the COVID-19 pandemic are fully cleared. After which, the tobacco products will be moved to a 40% GST rate.

On adding GST, cess, central excise duty, and the national calamity contingent duty (NCCD), the total indirect tax on tobacco is about 53%. This means more than half of the price paid by consumers goes toward taxes. As per government data, the average annual GST revenue earned from tobacco products over the past five years is nearly Rs 51,000 crore, with education cess and surcharge contributing another Rs 27,660 crore.