9000+ Professionals Urge FM: Extend Tax Audit & Statutory Audit Due Dates Now

The Chartered Accountants Social Affiliation (CASA) has sent an official representation (CASA/Rep/25-26/02), dated September 19, 2025, addressing the Honourable Finance Minister of India, Nirmala Sitharaman; Chairman of CBDT (Central Board of Direct Taxes); Joint Secretary of Tax Policy and Legislation; and Principal Chief Commissioner of Income Tax (Delhi). The representation requested an extension in the due date for filing the Tax Audit Reports (TARs) under the Income Tax Act, 1961, and Statutory Audit Reports (SARs) under the Companies Act, 2013 – financial year 2024-25 (assessment year 2025-26).

The Chartered Accountants Social Affiliation (CASA) highlighted the following points in its representation:

- Income Tax Act 1961

- According to Section 139(1) of the Income Tax Act, 1961, the due date for filing the Income Tax Returns (ITRs) for non-audit cases is July 31, 2025, for a financial year. Similarly, as per Section 139(1) of the Income Tax Act, the due date for filing the Income Tax Returns (ITRs) for non-audit cases is September 30, 2025, for a financial year. In between these two compliance dates, there is a statutory gap of two months; this time is sufficient for the taxpayers who are liable to file a Tax Audit Report (TAR) under Section 44AВ.

- As per the Companies Act, 2013:

- Section 129: Companies must prepare financial statements that give a true and fair view.

- Section 134: These financial statements must be approved by the Board of Directors along with the Auditor’s Report.

- Section 96: Every company must hold its AGM (Annual General Meeting) within 6 months of the end of the financial year.

So, statutory audits are legally required before AGMs can be held.

- Situation for AY 2025–26 (current year)?

- This financial year 2024-25, the Central Board of Direct Taxes (CBDT) had twice extended the due date for filing the Income Tax Returns (ITRs), initially from July 31, 2025, to September 15, 2025, and thereafter to September 16, 2025, considering the delayed release of utilities, frequent portal errors, and system nonfunctionality.

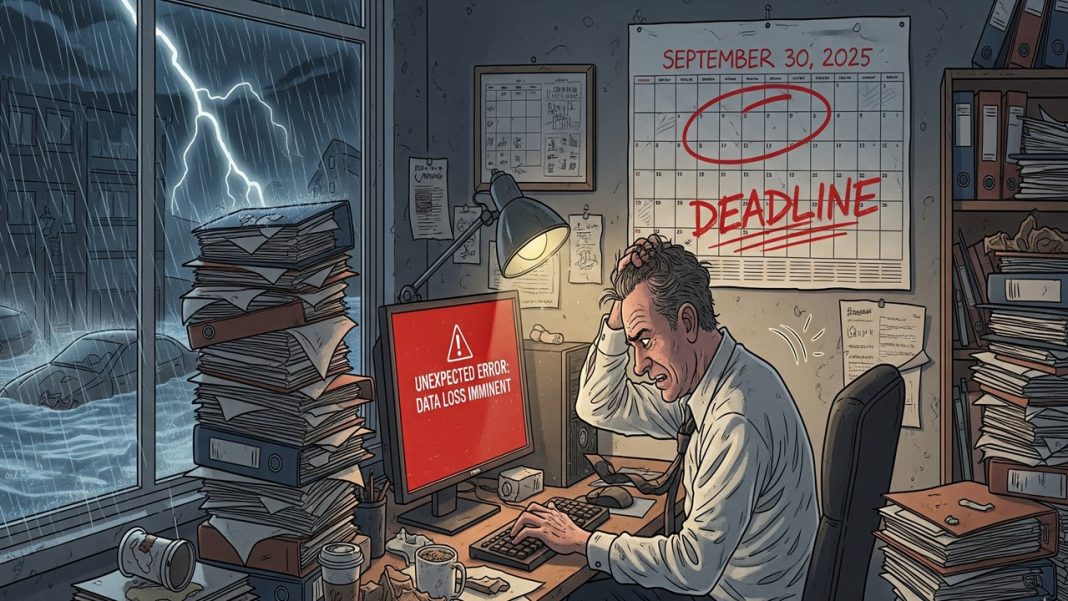

- As a conclusion, individuals are now left with only 14 days to file their Tax Audit Reports (TARs) for FY25. This is impossible in practice because an audit requires time and diligence.

- Frequent portal glitches, AIS mismatches, and data reconciliation issues further delay the process.

- If statutory audits are not completed, AGMs cannot be held, so companies also face compliance failures.

- This financial year, the utility for Forms 3CA-3CD and 3CB-3CD has been released late, only on July 18, 2025, while in the previous financial year, they were released on April 01.

- This financial year, severe floods and heavy rain adversely affected several parts of the country, including Punjab, Himachal Pradesh, Uttar Pradesh, Jammu and Kashmir, Uttarakhand, and nearby areas, and have disrupted normal work, travel, and professional activities.

- Humble Request

Citing the above issues, the Chartered Accountants Social Affiliation (CASA) made a humble request to the finance minister regarding the following:

- “Extension of the due date for furnishing Tax Audit Reports under Section 44AB for AY 2025-26 by at least two months, i.e., till 30th November 2025.

- The due date for completion of statutory audits under the Companies Act and for holding AGMs should also be suitably extended in line with the above, to avoid cascading hardship on corporates and professionals alike.”

For more information, refer to the official representation.