Kerala AAR Allows Transfer of ITC Balance Across GSTINs After Amalgamation

The current appeal has been filed by a company named M/s. Flytxt Mobile Solutions Private Limited, which is the legal appellant in the case. The company is registered under GST with GSTIN 32AABCF1310L1Z7 and has a registered address at 7A, Leela Infopark, Technopark, Attipra Village, Thiruvananthapuram, Kerala-695581.

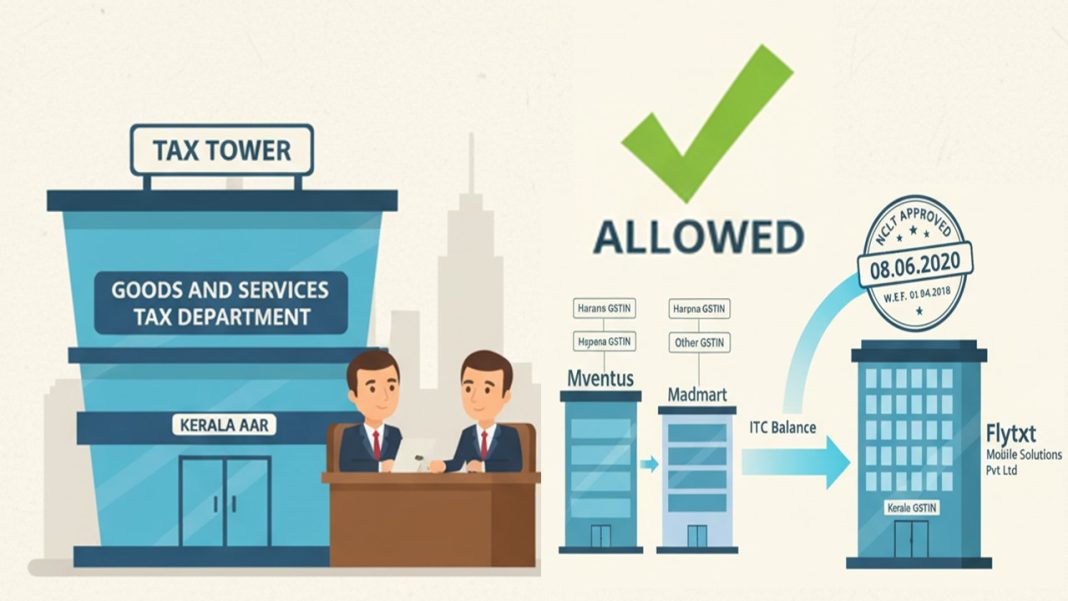

The appellant is engaged in the business of supplying information technology (IT) software services by providing comprehensive cloud solutions combining analytics, AI, and market automation. In the past, the appellant had merged its business with M/s Mventus Solutions Private Limited and M/s Madmart Services Private Limited, due to business reasons. This amalgamation was approved by the National Company Law Tribunal through an order dated 08.06.2020. The order was scheduled to take effect from 01.04.2018. After the merger, only the applicant company remained, and it took over all the business, including the assets and liabilities, of the merged companies.

Questions Asked by Applicant:

The applicant, M/s. Flytxt Mobile Solutions Private Limited has asked the following question before the Kerala Authority for Advance Ruling, Goods and Services Tax Department, Tax Tower, Thiruvananthapuram, seeking the advance ruling no. KER/23/2025, dated 23/07/2025:

“Question: Section 18(3), CGST Act 2017 and Kerala GST Act 2017 provide that where there is a change in the constitution of a registered person on account of sale, merger, demerger, amalgamation, lease, or transfer of the business with the specific provisions for transfer of liabilities, the said registered person shall be allowed to transfer the input tax credit that remains unutilized in his electronic credit ledger to such sold, merged, demerged, amalgamated, leased, or transferred business in such manner as may be prescribed. “M/s Mventus Solutions Private Limited had merged into the applicant. In view of the above, clarification is sought on whether the applicant is eligible to transfer the closing ITC balance appearing in the Electronic Credit Ledger of Mventus Solutions Private Limited (transferee company) in their Haryana GSTIN to the applicant’s (transferor company) Kerala GSTIN.”

What Did the Ruling Say?

In accordance with the Kerala Authority for Advance Ruling Goods and Services Tax Department, Tax Tower, Thiruvananthapuram, the following answer has been given to the above question:

The authority ruled that the appellant is eligible to transfer the closing balance of CGST and IGST appearing in the electronic credit ledger of the Haryana GSTIN of M/s Mventus Solutions Private Limited (transferee company) to the applicant’s TYURAD (transferor company) Kerala GSTIN on the merger of the former with the application. Further asserted that they can approach the appropriate jurisdictional authority for the resolution of the technical issue involved in this.

Citation: M/s. Flytxt Mobile Solutions Private Limited (AAR Kerala); No. KER/23/2025; 23/07/2025