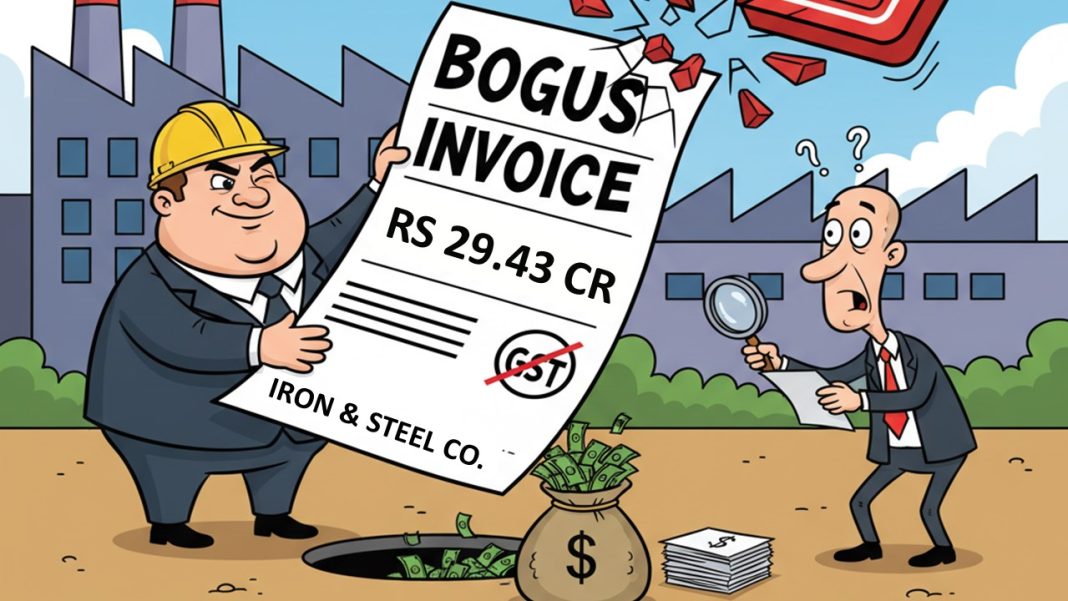

GST Scam: Iron and Steel Company Uses Bogus Invoice to Evade GST Worth Rs 5.29 crore

The GST officers in Ludhiana have detected a fake iron and steel company that evaded GST worth Rs 5.29 crore by creating fake invoices of Rs 29.43 crore. The company was located in Mandi Gobindgarh, district Fatehgarh Sahib.

By generating fake invoices, the company passed on input tax credit (ITC). During the investigation, it was found that the firm created fake e-way bills and other documents so that they could avoid the GST department’s investigation. The scam was discovered by the Ludhiana CGST Commissioner’s office.

As per an official statement, the company’s owner was arrested on Thursday and was sent for judicial custody.

The ITC, or the Income Tax Credit, is the tax that a business has paid on the purchases. This input credit can be utilised to reduce the output tax liability. The ITC can be claimed subject to some conditions. One of the conditions is having a proper invoice. However, some companies generate fake invoices for purchases that never happened. These fake invoices are then used to claim ITC against the output tax, reducing their tax liability. This is a clear act of tax evasion, and it can result in heavy penalties, interest, and imprisonment.