CBDT Issues Circular Regarding Assignment of Proper Officers Under Sections 74A, 75(2), and 122 of the CGST Act

The Central Board of Indirect Taxes and Customs (CBIC) has recently issued a circular (No. 254/11/2025-GST), where it has clarified which officers are assigned under sections 74A, 75(2), and 122 of the Central Goods and Services Tax Act (CGST Act) and related rules.

Key Sections

The key sections mentioned in the circular as as follows:

- Section 74A: It is for situations where taxes are not paid correctly, short-paid, or erroneously refunded, or if input tax credit is wrongly utilised, for the financial year 2024-25 onwards.

- Section 75(2): It applies to cases where an appellate authority concludes that a show cause notice under section 74(1) is not sustainable because an allegation related to fraud or evasion of tax was not established. In this case, a proper officer must determine the correct tax payable.

- Section 122: It outlines penalties for certain tax offences.

- Rule 142(1A): It is for the situation when the communication (in Form GST DRC-01A) is issued before issuing show cause notices under certain sections (73, 74, and 74A of the CGST Act).

Designated Officers

The circular assigns specific officers to handle these tasks. The designated officers are as follows:

- Additional or Joint Commissioner of Central Tax

- Deputy or Assistant Commissioner of Central Tax

- Superintendent of Central Tax

These officers are required to function under Sub-sections (1), (2), (3), (6), (7), (8), (9) and (10) of Section 74A, Section 122, and Rule 142(1A) of the CGST Rules, 2017.

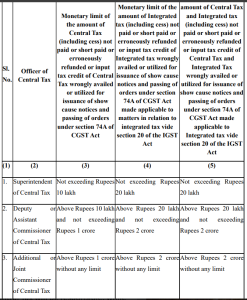

Monetary Limit for Issuance of SCN and Orders u/s 122

The circular also outlines the monetary limit for the issuance of the show cause notices and passing order under section 74A of the CGST Act.

- Superintendent of Central Tax can handle amounts of tax, including cess, up to Rs 10 lakh for Central Tax, and up to Rs 20 lakh for Integrated Tax.

- Deputy or Assistant Commissioner can handle amounts above Rs 10 lakh but less than Rs 1 crore for Central Tax, and above Rs 20 lakh but less than Rs 2 crore for Integrated Tax.

- Additional or Joint Commissioner can handle cases where the tax amount exceeds Rs 1 crore for Central Tax, and Rs 2 crore for Integrated Tax.

If a show cause notice issued under section (1) of section 73 or 74A of the CGST Act, 2017, involves both Central Tax and Integrated Tax, the combined tax amount is used to determine which proper officer will handle the case.

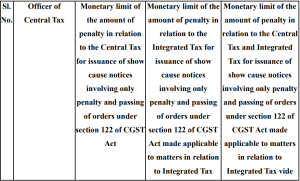

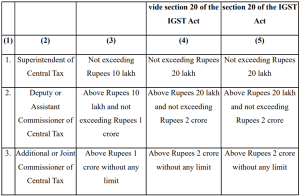

Monetary Limit for Issuance of SCN and Orders u/s 122

Here is the monetary limit for issuing the show cause notices and passing orders under section 122 of the CGST Act.

Refer to the Official Cicrular for More Information