CBIC Grants Five-Day Extension For GSTR-3B Filing Due To Diwali Festivities And Compliance Overlap

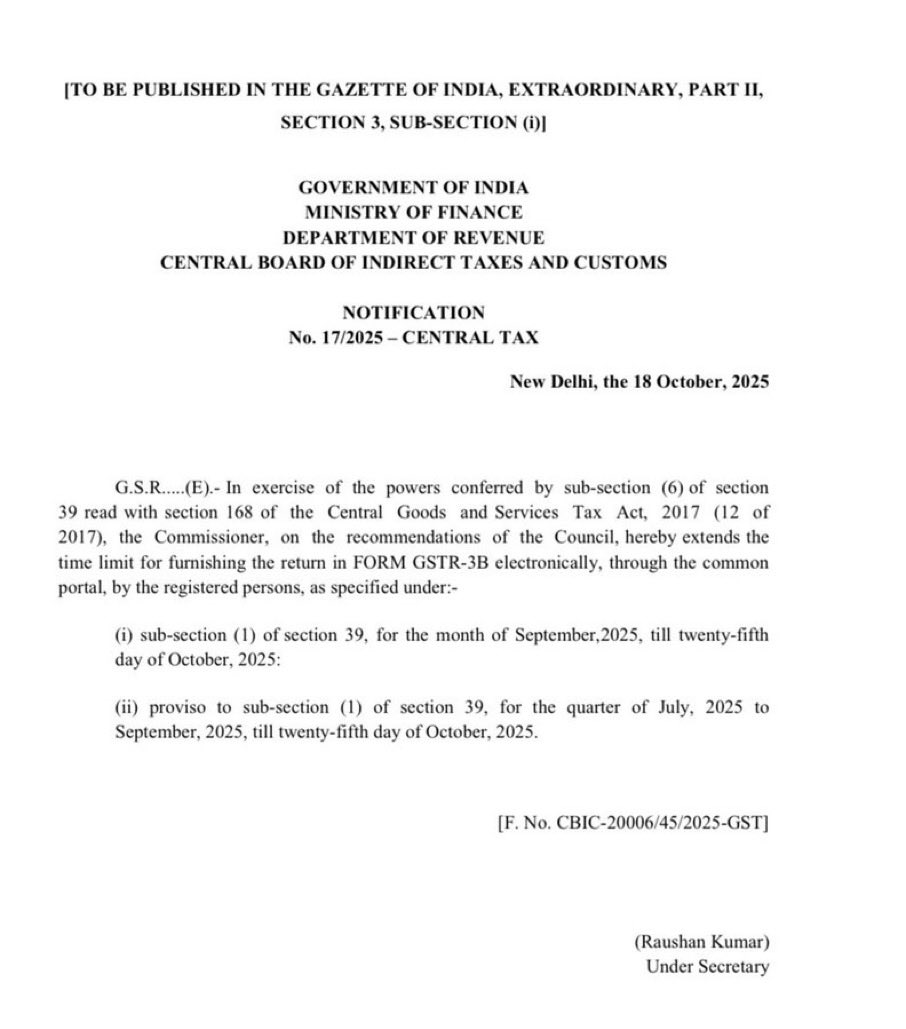

Recently, the government has taken significant action on GST returns by extending the due date of filing the GSTR-3B form until October 25, 2025. The government took this major action on October 19, 2025, and announced this decision via a notification issued by the Central Board of Indirect Taxes and Customs (CBIC). Meaning, taxpayers liable to file GSTR-3B now have an extra five days to file their returns. CBIC has made this extension after consultation with the GST council and in exercise of its powers granted under sub-section (6) of section 39 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017).

Previously, the due date for filing the GSTR-3B returns was October 20, 2025. Now, as per the latest update announced by CBIC, the due date for filing GSTR-3B returns for the month of September and the July-September quarter is now October 25, 2025. The CBIC has also shared this crucial information on its official Twitter handle (platform ‘X’).

@cbic_india extends the GSTR-3B filing deadline!

✅ For Monthly filers (Sept 2025)

✅ For Quarterly filers (Q2: July–Sept 2025)

🗓️ New Due Date: 👉 25th October 2025

📄 (Notification No. 17/2025 – Central Tax, dated 18.10.2025) pic.twitter.com/E0pdzyVHEq

— CBIC (@cbic_india) October 19, 2025

The CBIC’s official notification reads, “In exercise of the powers conferred by sub-section (6) of section 39 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Commissioner, on the recommendations of the Council, hereby extends the time limit for furnishing the return in FORM GSTR-3B electronically, through the common portal, by the registered persons, as specified under:-

(i) sub-section (1) of section 39, for the month of September, 2025, till the twenty-fifth day of October, 2025:

(ii) proviso to sub-section (1) of section 39, for the quarter of July, 2025 to September, 2025, till the twenty-fifth day of October, 2025.”

GSTR-3B is a monthly self-declaration return form under the Goods and Services Tax (GST) system. Registered taxpayers use this form to declare their summary of outward supplies, inward supplies, input tax credit (ITC) claimed, and the taxes paid. This return needs to be filed on the 20th, 22nd, and 24th of each month based on different categories of taxpayers.

It was already expected that an extension to the due date of GSTR-3B return filing would be granted, as festival dates and return filing dates were overlapping each other, hence creating problems in compliance. Like this year, Diwali is falling on two days, i.e., October 20 and 21, 2025. Meaning, people nationwide will celebrate this festival on both dates, some on the 20th and some on the 21st, and the legal deadlines for filing Form GSTR-3B were October 20, 22, and 24, 2025, which clashed with each other. Therefore, the government has taken his major step.