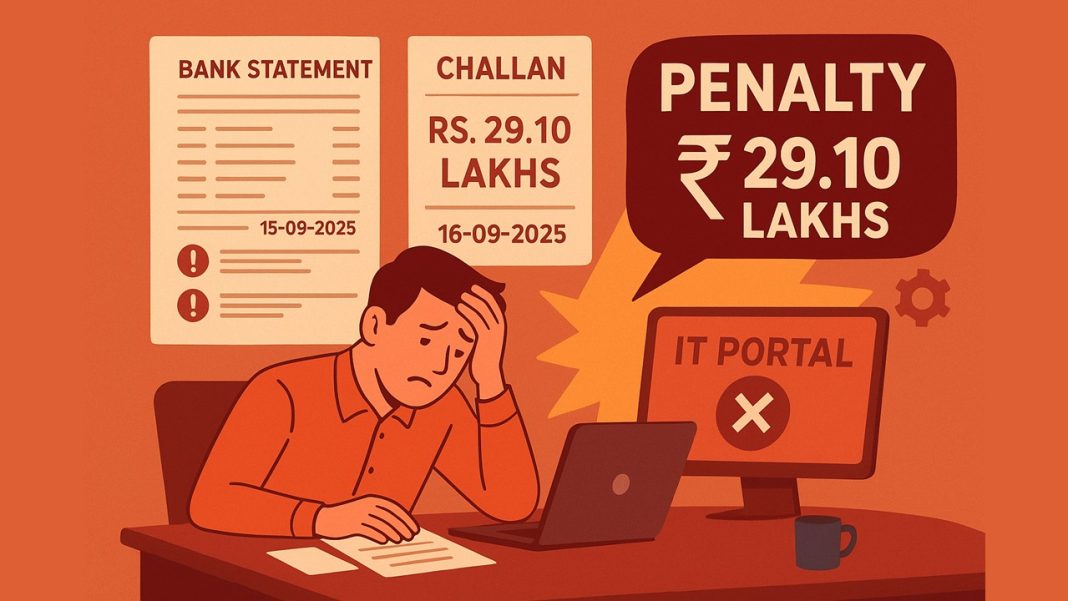

Taxpayer Penalised Rs. 29.10 Lakhs Due to IT Portal Glitch on Advance Tax Due Date

A user at platform ‘X’ has tried catching the attention of the Honourable Finance Minister, Nirmala Sitharaman, and the Income Tax Department on the serious and very unfortunate issue that one of his clients has faced due to technical glitches on the Income Tax portal on the Advance Tax due date, i.e., September 15, 2025.

As we are all aware, September 15, 2025, was the due date for paying the second instalment of advance tax. The client of the user tried paying a significant amount of Rs. 9.71 crores through the tax portal multiple times; however, each of his transactions failed due to technical glitches in the portal, and later the amount was reserved in his account. He properly complied with the law and paid the instalment amount promptly; however, it could not reach the department by September 15 due to glitches in the tax portal.

The payment was finally processed on September 16, which is just one day late from the due date; however, till then, the system had already considered the payment as “late.” As per the law, since the advance tax was received on September 16, instead of September 15, a 3% interest under section 234C has now been automatically imposed, amounting to a massive Rs. 29.10 lakhs in unjust interest. However, this situation was not created intentionally; hence, it is not the fault of the taxpayer. It occurred merely due to a technical glitch in the Income Tax Portal and the delayed extension announcement.

Key Concerns and Questions Raised:

“A) Why is Infosys never held accountable for failures?

- B) Why was the due date extension announced only at midnight when timely relief could have prevented this loss?

- C) Why was 1-day extension benefit not extended to Advance Tax cases, even though the same portal was used?”

This is not just a one-off issue. Many other genuine, law-abiding taxpayers are being penalised for no fault of theirs, only due to glitches in the compliance system. When such heavy interest (like Rs. 29.10 lakhs) is imposed without just cause, it destroys trust in the tax system and demotivates honest taxpayers. If India wants to retain its wealth creators and attract global capital, the compliance systems must be reliable, fair, and timely.

At the end of the post, the user kindly intervened and waived off this unjust interest of Rs. 29.10 lakhs, which was entirely due to portal inefficiency. Hence, requested the government to grant one-day relief for advance tax payments as well, just like other due dates, and ensure that the IT portal functions smoothly on critical due dates in the future.

Further, urges the tax department to announce extensions for tax audits and ITR (for audit cases) well in advance, not at the last minute. This would help thousands of professionals and taxpayers plan better and avoid confusion or penalties.

The user has also attached some crucial documents to the post as proof that the situations he discussed are genuinely real. He attached:

- The bank statement clearly shows failed transactions and reversals on September 15, 2025.

- Challan confirming successful payment on September 16, 2025.

He said, “This is not a rant; it is a genuine appeal on behalf of compliant taxpayers who are trying to follow the law but are being penalised for failures beyond their control. I rarely speak out publicly about due date issues, but this case is too serious to ignore.”

Unjustified Interest of ₹29.10 Lakhs due to Portal Glitches

(My Client is forced to pay 3% interest for last quarter due to Advance Tax Payment failure on Portal on 15th September)

Hi @nsitharaman ma’am & @IncomeTaxIndia @nsitharamanoffc

Please check attached images of… pic.twitter.com/Lm9Qashho8

— Avinash Rao (@theavinashrao) September 18, 2025