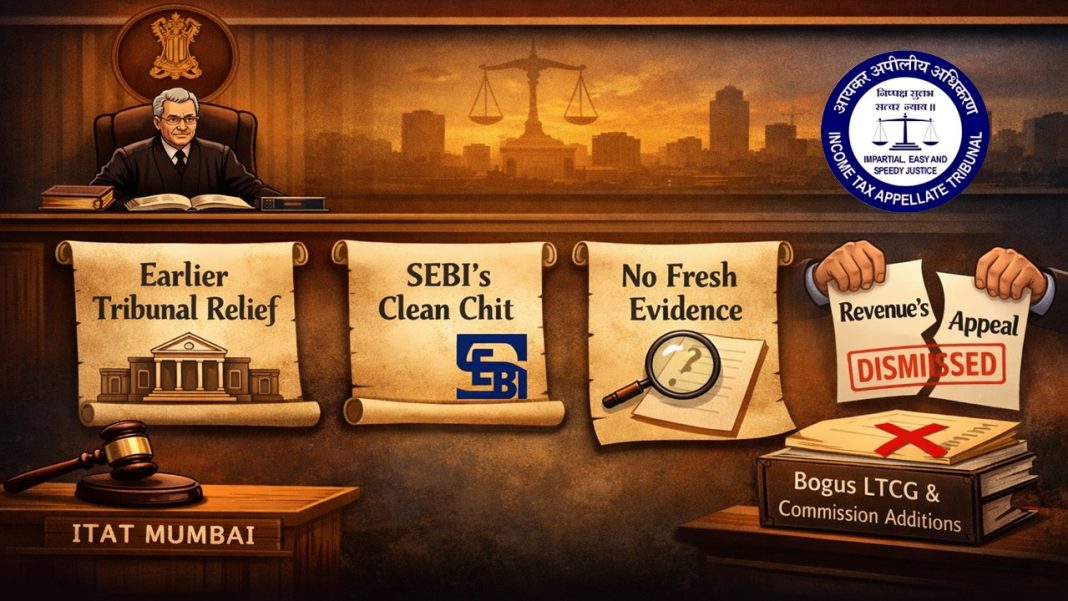

ITAT Dismisses Revenue Appeal for Lack of Evidence, Upholds Deletion of Rs. 2.92 Crore Bogus LTCG Addition

ITAT Mumbai upheld CIT(A)’s order by deleting bogus LTCG and commission additions raised on the assessee’s income. The tribunal relied on earlier ITAT relief, SEBI’s clean chit, and the absence of new evidence for the Assessment Year 2014-15 matter. Dismissed the tax department’s appeal.

The Income Tax Department has filed its present case in the ITAT Mumbai against a taxpayer named Sunita Chaudhary, challenging an order dated February 23, 2024, passed by the CIT(A)/NFAC Delhi. The case is related to the Assessment Year 2014-15.

The dispute relates to long-term capital gains (LTCG) earned by the assessee from the sale of shares of M/s First Financial Services Ltd. during the year in consideration. The assessee had sold total shares amounting to Rs. 3,15,72,400 through a recognised stockbroker, Anand Rathi Shares and Stock Brokers Ltd., from her regular demat account. After reducing the purchasing cost, she treated her total LTCG of Rs. 2.92 crore as exempt under section 10(38) of the Income Tax Act in her ITR.

In conclusion to information received from the Directorate of Investigation alleging misuse of penny stocks to generate fake LTCG, the Assessing Officer (AO) reopened the case of the assessee, treated the LTCG of Rs. 2,92,12,400 as bogus, and made an addition of the same to the assessee’s income as unexplained investment/income from other sources. An additional amount of Rs. 78,931 was also added as alleged commission paid for accommodation entries under section 69C. The assessment order was passed under Section 143(3)/147 of the Act.

The aggrieved assessee filed an appeal before the CIT(A)/NFAC, challenging the order of the AO. She asserted that she is an honest investor, regularly trades in shares, and has also earned dividend income. She also emphasised that previously, SEBI had initially restrained her during the investigation; however, later, after a detailed inquiry, SEBI revoked the restraint in 2017, on the grounds that no contravention or fraudulent activity was found against her. She also highlighted that in her own case, pertaining to the Assessment Year 2013-14 involving the same company, the tribunal has already deleted a similar addition amounting to Rs. 29,212,400.

The CIT(A), after examining the facts of the case and relying on ITAT’s earlier decision and the SEBI order, deleted both the LTCG addition and the commission addition made by the AO. Ruled in favour of the assessee.

The aggrieved tax department filed the current appeal in the ITAT Mumbai. When the tribunal analysed the case, it noted that no additional facts or evidence had been brought by the tax department. Therefore, the tribunal did not find it relevant to interfere with the CIT(A)’s ruling. As a result, the ITAT upheld the CIT(A)’s order. Accordingly, the appeal filed by the Revenue was dismissed.

Citation: ITO Vs Sunita Chaudhary (ITAT Mumbai); I.T.A. No. 2124/Mum/2024; 19/01/2026; 2014-15