Income up to Rs. 12 Lakh Now Tax-Free Under New Regime; New Slab Rates Introduced

The budget for 2025-26 brought in some drastic changes in the personal income tax, according to the new tax structure, an absolute tax exemption is given up to an annual income of Rs.12 Lakh. In case of salaried taxpayers, the exemption is made effective up to Rs.12.75 Lakh that covers a sum of Rs.75,000 of standard deduction. These are financial relief measures especially for the middle class.

This is an amended tax system that will significantly decrease the tax burden to greater disposal incomes on the recipients’ hands. It should, therefore be a real source for increased household spending, savings, and investing, which leads to economic growth. The government insists these reforms will be targeting empowering middle-class families and enhancing their quality of life.

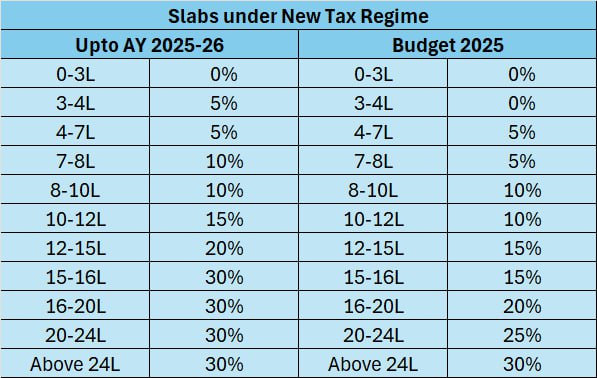

As part of the changes, tax slabs and rates have been restructured across the board. The revised slabs are as follows:

Apart from the introduction of new slab rates, rebate limit under section 87A also increased from Rs.25000 to Rs.60000 under new tax regime. There are no changes in old tax regime.

This is a simple and hence all-inclusive structure. All tax payers from the lowest to the highest income bracket benefit from reduced liabilities due to it. It will invite further economic stability through enhanced financial confidence and long-term investments.

These measures will help the government to devise a balanced system of taxation, relaxing the financial stress it invokes while bringing about growth and development in the economy. It is, in fact, this middle-class welfare that accentuates the need for fair progress and inclusion in the taxation policies themselves.