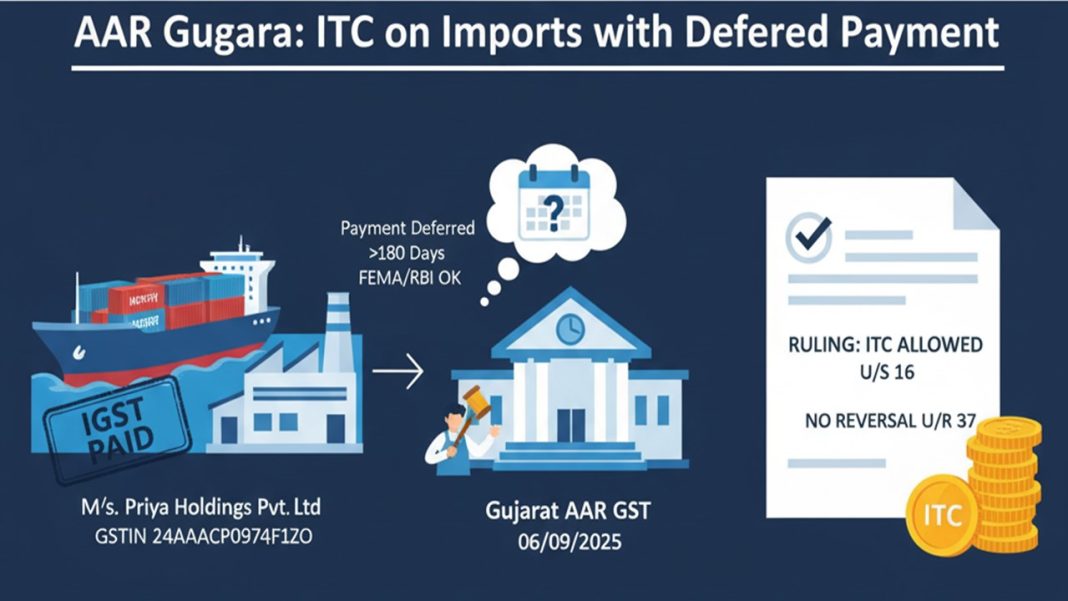

ITC allowed on IGST Paid for Imports despite Deferred Payment Beyond 180 Days: AAR

The present application (No. Advance Ruling/SGST&CGST/2025/AR/22), dated 04/07/2025, has been filed by a company named M/s. Priya Holdings Private Limited (applicant), before the Gujarat Authority for Advance Ruling Goods and Services Tax, D/5, Rajya Kar Bhavan, Ashram Road, Ahmedabad – 380009.

The company is registered under the GST department with a registered address at Plot No. 1563/A, Aashirwad Opp. Panna Tower, Rupani, Nr. Laxmi Apartment, Bhavnagar, Gujarat-364002, hence possesses a GSTIN no. 24AAACP0974F1ZO. Two hearings have taken place on the matter on 29.07.2025, 19.08.2025.

The applicant is involved in the business of trading scrap of various ferrous and non-ferrous metals, such as Stainless Steel Melting Scrap, Waste and Scrap of Iron and Steel, Alloy Steel Scrap, Copper Scrap, etc. The applicant was earlier involved in ship-breaking operations. Now the applicant is actively working to find different opportunities available to re-enter the ship-breaking industry in the future. The applicant is also an importer of goods from outside India, and on these types of transactions, it discharges the applicable duty taxes, including the imposable IGST¹ under section 3(7) of the Customs Tariff Act, 1975. Hence, the IGST paid at the time of import is claimed as ITC2.

Questions Asked by Applicant:

The applicant, M/s. Priya Holdings Private Limited has asked the following question seeking the AAR Gujarat (No. GUJ/GAAR/R/2025/34), dated 06/09/2025, under Clause (d) of Section 97(2) of the CGST/GGST Act, 2017:

“Question: Whether the Input Tax Credit (ITC) of Integrated GST (IGST) paid on the import of goods, where payment to the foreign supplier is deferred beyond 180 days from the date of invoice but made within the time limits permitted under FEMA and RBI guidelines, remains admissible under Section 16 of the CGST Act, 2017, or is required to be reversed as per the second proviso to Section 16(2) read with Rule 37 of the CGST Rules, 2017.”

Answers Given by AAR Gujarat:

The Gujarat Authority for Advance Ruling Goods and Services Tax (GST) has given the following answer to the question of the applicant:

Answer: The Integrated GST (IGST) paid at the time of import of goods, where payment to the foreign supplier is late by more than 180 days from the date of invoice (legal limit to make payment on such transactions), but is made before the due date as allowed under FEMA and RBI instructions; in that case too, the Input Tax Credit (ITC) is allowed to be availed under Section 16 of the CGST Act, 2017, and is not permitted to be reversed according to the second proviso to Section 16(2) read with Rule 37 of the CGST Rules, 2017.

Citation: M/s. Priya Holdings Private Limited (AAR Gujarat); Advance Ruling No. GUJ/GAAR/R/2025/34; 06/09/2025