Kerala Urges Centre to Withdraw 40% GST Hike on Lottery Tickets, Citing Job and Income Losses

The 56th GST Council meeting, held on September 3-4, 2025, proposed to bring a hike in the GST (Goods and Services Tax) rate on lotteries and other gambling activities from 28% to 40%, effective from September 22, 2025.

The aim behind the implementation of such reform was to increase the revenue of the central government, and it is part of a larger tax rationalisation effort for gambling and high-value entertainment sectors. However, states like Kerala are strongly opposing this move. Kerala says the move is putting negative financial impacts on the lottery market and leading to losses of jobs for lottery agents and vendors, which ultimately will adversely impact their families and livelihoods.

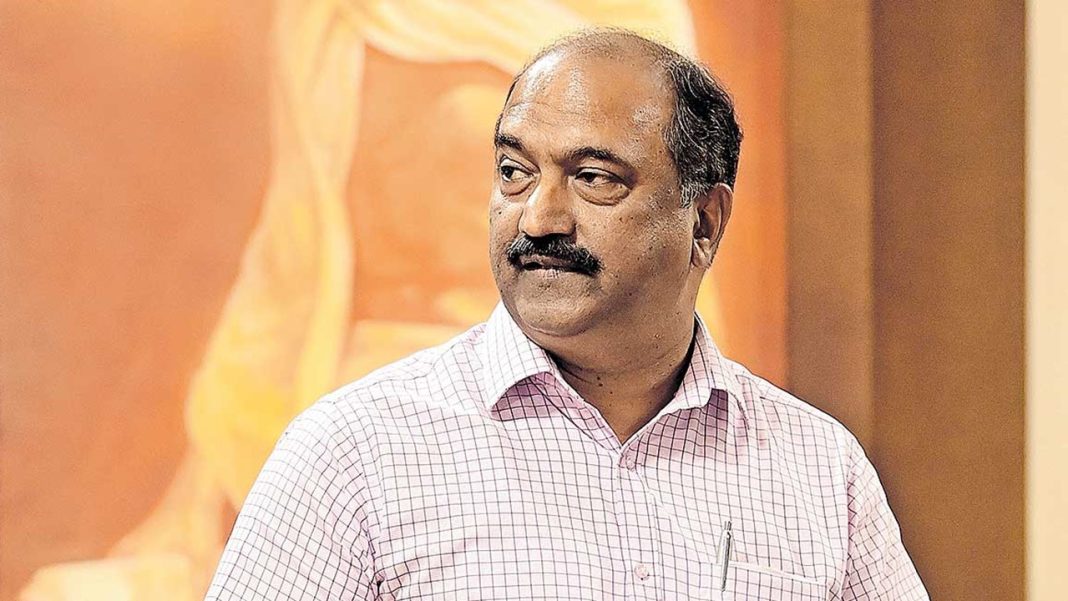

The Finance Minister, K.N. Balagopal, said this week that increasing the GST on lottery tickets from 28% to 40% could badly affect the Kerala State Lotteries. He explained that this change would hurt the livelihood of over two lakh lottery agents, vendors, and their families. Mr Balagopal also mentioned that he had shared Kerala’s concerns about the lottery issue in the Group of Ministers’ meeting that discussed the new GST changes.

Recently (on Friday), the Kerala Lottery Protection Committee, led by CPI(M) leader M.V. Jayarajan and including MPs from Kerala and trade union leaders in the sector, filed a petition to the Union Finance Minister Nirmala Sitharaman, requesting that to drop their move to increase GST on lotteries from 28% to 40%.

The committee highlighted the fact that there are around two lakh people dependent on lottery ticket sales for their livelihood. It flagged that the government was aiming at increasing tax on luxury items, but a lottery is not a luxury item. Later, Mr Jayarajan showed a post on Facebook where a user said the commission per lottery ticket was worth Rs. 50 will decrease by Rs. 4 due to the increment of GST, which will majorly affect lottery agents and vendors. Mr Jayarajan said, “In a scenario where the 28% slab is removed, the GST on lottery should instead be reduced to 18%.”