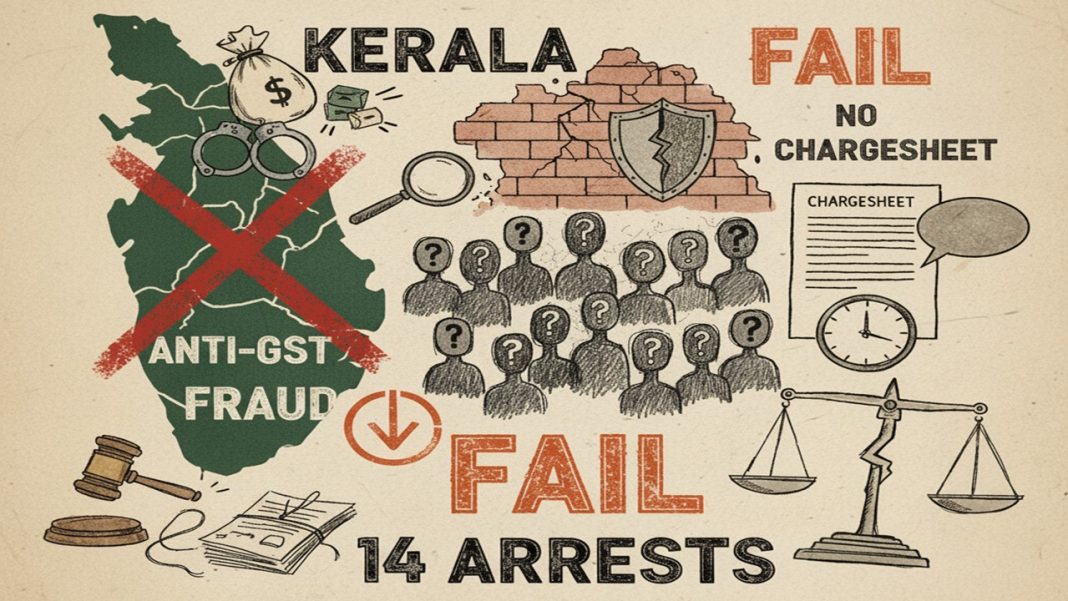

Kerala’s Anti-GST Fraud Campaign Failing as No Chargesheet Filed Despite 14 Arrests

Kerala’s highly publicised anti-GST Fraud Campaigns appear to be failing, as since 2021, even though there were 14 arrests in the tax evasion cases, each for Rs 5 crore, not even a single chargesheet has been filed against them. The accused are released on bail, and no trial has started. This reveals a lot about the system failures of Kerala’s Anti-Fraud Campaign.

Despite big claims by Finance Minister K N Balagopal that the state is taking all possible steps, the reality is very different. Without trials or punishments, fraudsters are not scared. This is eroding the state’s efforts and allows the tax evaders to walk freely.

In 2022, the state government constituted a special additional chief judicial magistrate court in Ernakulam to handle the GST fraud cases under state and central tax laws. This court was supposed to speed up trials. But more than three years later, the court has not received even a single chargesheet from the GST intelligence department.

The main reason for this failure is the government’s inability to appoint a panel of prosecutors. Since there are no legal teams, the cases are still frozen. As per a GST department source, the GST department cannot further proceed with the investigated cases until the panel is formed. The department has already done its job with the arrests, but without prosecution, all efforts are going to waste.

On the other hand, the centre has a better track record. The Central Board of Indirect Taxes and Customs (CBIC), between May and July 2023, found 9,369 fake firms and fraud of over Rs 10,900 crore. Since 2017, 331 arrests have been made across the country. Kerala reported 135 fake registration cases involving Rs 162 crore, but there have not been any recoveries or prosecutions. This shows that Kerala needs to urgently shift from effective policing to effective prosecution.