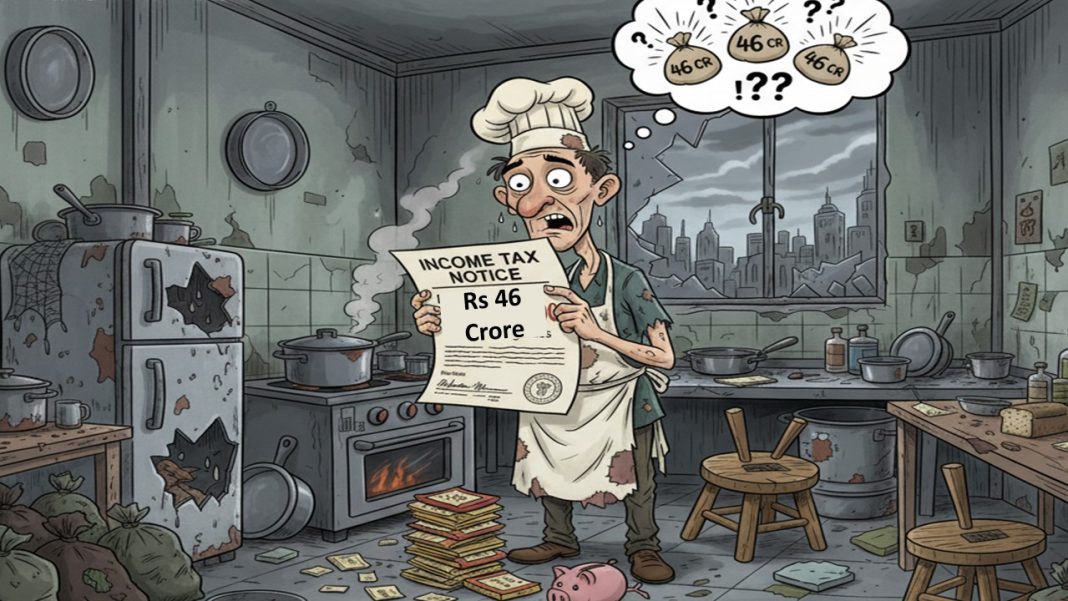

Madhya Pradesh: Cook Barely Earning Rs 10,000 Receives Tax Notice Worth Rs 46 Crore

In a shocking case from the Bhind District of Madhya Pradesh, a small dhaba cook, who earns Rs 10,000 a month, received a tax notice of Rs 46 crore.

The man is being named as Ravindra Singh Chauhan, who is from Gandhi Nagar in Bhind and is working as a cook in Gwalior. He was too stunned when he received the notice, as he claims to have never seen such an amount in his life. This has forced the victim to leave his job and shuttle between income tax offices and police stations.

Ravindra claimed that there have not even been transactions of three lakh Rupees in his bank account. He told the media that he previously worked at a toll plaza of a private company, where a supervisor, Shashi Bhushan Rai, insisted that Ravindra open a bank account in Delhi. The supervisor lured him into faster PF withdrawal and an extra monthly incentive of Rs 5,000 to Rs 10,000. Fascinated by this offer, Ravindra and the other three employees came with him to Delhi in November 2019 to open the accounts.

However, Ravindra claimed that he never received any promised amount. Due to this, he tried to close the account, but he was informed that he cannot close the account until he gets approval from the GST branch. So, he left this matter after trusting Shashi again, who quit the job by 2022 and then disappeared. Ravindra also lost when the toll contract ended.

Later on April 9, 2025, Ravindra received a notice from the Income Tax Department at his house in Bhind. The cook, who left the school after 6th grade, could not understand the English words on this notice. When he again received a notice in July 2025, he went to a neighbourhood lawyer, Pradyuman Singh Bhadoria, who told him about this shocking Rs 46 transaction carried out under his name.

After investigation, it was found that Ravindra had two accounts, one in Bhind and the other in Delhi. The Delhi account was linked with a company named Shaurya Trading Company, through which transactions of Rs 46 crore were funnelled. Around Rs 13 lakh was still deposited in this account.

The lawyer helped Ravindra to reach out to the Income Tax Office in Gwalior and later registered a complaint at the Siraul Police Station. However, the Gwalior police directed him to go to Delhi and file a complaint, saying that the case fell under Delhi’s jurisdiction.

Ravindra now spends his days running from one office to another. Since he left his job, his financial condition has also worsened.

This is a clear case of identity theft, where the scammers use the identity of another person and operate a company under their name to carry out large transactions to avoid paying taxes. One should never give their personal details to an unknown person.