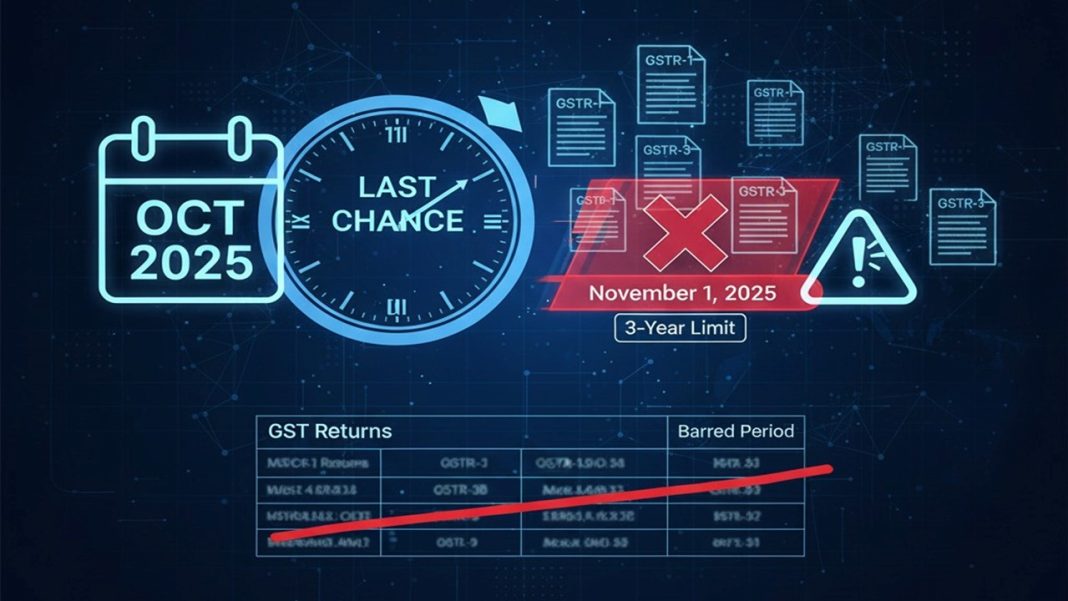

Last Chance to File! Pending GST Returns Older Than 3 Years Barred from November 1st

The Goods and Services Tax Network (GSTN) has issued an official advisory dated September 25, 2025, to file pending returns before the expiry of three years.

The Finance Act, 2023 (8 of 2023), issued on March 31, 2023, came into effect on October 01, 2023, via Notification No. 28/2023-Central Tax dated July 31, 2023. According to the act, the GST returns, including GSTR-1, GSR-1A, GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8, and GSTR-9 or 9C, filed under Section 37 (Outward Supply), Section 39 (Payment of Liability), Section 44 (Annual Return), and Section 52 (Tax Collected at Source), will not be permitted to be filed after the expiry of a period of three years from the statutory due date of filing.

Therefore, the designated GST returns above will not be allowed for filing after the set expiry date of three years. This time limit for filing pending returns will be updated on the GST portal from the tax period of October 2025. Meaning, any GST return whose statutory due date of filing was three or more years back and has not been filed yet till the tax period of October 2025 will not be permitted to be filed. In this context, GSTN has already issued an advisory dated October 29, 2024.

To make this information simpler to understand, below is the table outlining the latest GST returns that will be barred from filing with effect from this October 2025 tax period.

GST Returns Barred from Filing w.e.f. November 1, 2025:

| GST Form | Barred Period (w.e.f. 1st November, 2025) |

| GSTR-1 / IFF | Sep-22 |

| GSTR-1Q | July – September 2022 |

| GSTR-3B / Monthly | Sep-22 |

| GSTR-3BQ | July – September 2022 |

| GSTR-4 | FY 2021–22 |

| GSTR-5 | Sep-22 |

| GSTR-6 | Sep-22 |

| GSTR-7 | Sep-22 |

| GSTR-8 | Sep-22 |

| GSTR-9 / 9C | FY 2020–21 |

Taxpayers are advised to check if they are also due to file any of the above GST returns whose due dates were three or more years back, and file their GST returns as soon as possible if not filed till now.